ESG Policy

1. A growing need for climate change solutions

1.1 The turn of this decade has presented unprecedented change: the global pandemic, a surge in demand for climate action, and the call for accountability on ESG.

1.2 In a world that is already 1°C warmer than pre-industrial levels, the time to act is now. Climate action demands a focus both on reducing GHG emissions to net zero, as well as adapting to the changes in climate that are now being seen.

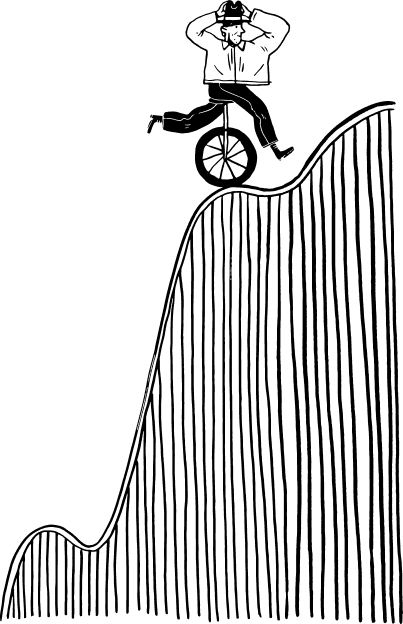

1.3 Most of the transition towards a net-zero Europe by 2050 can be achieved with existing mature and early-adoption technologies*. The challenge resides in scaling-up such businesses to implement the transition in due time.

*Net-Zero Europe, Decarbonization Pathways and socio-economic implications”, November 2020, McKinsey.

2. ESG principles subscribed to by the fund

2.1 At Junction, we put capital at work consistent with the Paris Agreement’s goal of limiting global average temperature increase to well below 2°C above pre-industrial levels, and as close as possible to 1.5°C. We are committed to the EU Green Deal and its greenhouse gas (GHG) reduction targets, notably to reduce net GHG emissions by 55% by 2030, and to reach net-zero emissions by 2050, in the EU.

2.2 We invest in opportunities and/or technologies that are central in that transition, either through supporting (i)reduction in GHG emissions; or (ii) adaptation to a warmer world. As such, we see opportunity in two coreareas: energy transition and efficient buildings. Adjacent opportunities in sustainable industry, sustainablemobility and eliminating pollution are also in scope.

2.3 We are not a pure-play impact fund, nor not-for-profit. We serve our fiduciary duty to investors in creating long-term value, identifying opportunities to achieve superior investment returns while contributing to climate-change solutions. Junction differentiates itself through a combination of private equity professionalism and sector-specific entrepreneurial / executive experience. We fill the gap between early-stage venture capital and large-scale buy-out capital. We apply a value creation agenda based on experience in electrification, retrofitting, data-driven SaaS, tech combination, asset sharing and hydrogen.

2.4 Whilst we are guided by the EU Green Deal targets, we are conscious that some companies will be able to reduce emissions faster than others. Throughout the entire investment lifecycle, we set company specific KPIs related to 2 major subjects:

- ESG Management: the extent to which a portfolio company incorporates ESG principles, risks andopportunities into its operational and strategic decision making. Particular attention will be given to the Environmental aspects of ESG, albeit not exclusively.

- Sustainability Impact: the extent to which a portfolio company reduces its GHG emissions and enablesthe low-carbon transition and/or climate change adaptation.

We will ensure individual investments either already have a strong score on these indicators, or have the potential to create a large ‘delta’.

3. Our approach

3.1 How these ESG-principles are integrated into the Fund’s investment process

3.1.1 At the level of the fund manager, Junction has a strong governance framework to articulate accountability and oversight of ESG in general and climate change in particular.

One of our Managing Partners oversees ESG efforts across the fund, ensures ESG remains a top- priority and makes sure the fund stays on top of policy changes.

A senior team member will be nominated, to monitor and report on the ESG KPIs and compliance with the ESG policy, complemented with external audits.

All team members are actively involved in ESG implementation on a day-to-day basis, both within the fund as well as within our investments. We expect our team to be ESG aware, knowledgeable of the frameworks (incl. EU taxonomy), integrating ESG into the fund’s investment decisions, and taking care of transparent reporting once investments are made.

3.1.2 We apply critical thinking to all investment opportunities to ensure alignment with our overall agenda of “enabling net-zero”. As part of this, all investment opportunities are screened against Junction’s Sustainable investment objective, assessing their contribution to the energy transition, the Do No Significant Harm principles and good governance practices.

The fund aims to make a minimum 50% of sustainable investments which are aligned with our internal Sustainable Investment Objective, which is determined based on 4 evaluation criteria:

- The Fund invests in opportunities and technologies that are central in the energy transition and support climate change mitigation and climate change adaptation goals

- Excluded activities based on EIF Guidelines on Restricted Sectors, EIF Paris Alignment Restrictions, and for restricted activities with high-intensive and/or high CO2-emitting industries: activities eligible under the EU Taxonomy or EIF’s Climate Action and Environmental Sustainability Objectives (CA&ES)

- Screening against Do No Significant Harm principles within the EU Taxonomy

- Screening against good governance practices, looking into sound management structures, employee relations, remuneration of staff and tax compliancy

However, the Fund doesn’t have as an objective to make EU Taxonomy aligned investments, given that (i) the methodology and data availability on reporting under the EU Taxonomy continues to develop, and (ii) the Belgian Financial Services and Markets Authority (FSMA) currently prohibits any Belgian-based fund to state that investments qualify as sustainable under the EU Taxonomy*.

Throughout the life of the Fund, when data from portfolio companies becomes more readily available, we aim to informally report on the EU Taxonomy alignment of our portfolio.

Through our portfolio, we aim to accelerate the emissions-reduction pathway by financing the technologies that reduce GHG emissions as well as the technologies that minimise the negative impacts of global warming.

As long as positive sustainability impact and no significant harm are identified, we also consider investing in opportunities where we can significantly improve ESG management through our ownership, rather than only screening for best practice. In any case, we do not invest in companies or activities outlined in our exclusion list (Appendix A).

3.1.3 In the selection of individual investments, we apply a rigorous due diligence approach identifying ESG risks in the companies’ operations or supply chains. We also screen for conflicts of interest, both in terms of business practice and ESG performance, and we do not pursue opportunities where such a conflict cannot be resolved.

As part of the due diligence process, we explicitly evaluate each opportunity against identified material ESG themes, including:

| ENVIRONMENTAL | SOCIAL | GOVERNANCE |

|

|

|

3.1.4 The findings from the due diligence process establish the basis for our approach to engagement and monitoring with invested companies.

3.2 Approach to deliver substantial progress on ESG-KPIs at the level of each Portfolio Entity as well as at the level of the Manager

3.2.1 Once we have made the investment decision, we work closely with management to define and select feasible pathways to the Green Deal targets in 2030 and 2050. Given the range of companies invested in, individual targets will be set. While some climate change mitigation opportunities may be able to set ambitious carbon reduction targets ahead of others (e.g., adaptation opportunities), all investments will have to demonstrate a carbon reduction plan.

To reduce the risk of inertia, we break down long-term targets into intermediary steps across 5- year time frames. As part of this, we will identify and develop action plans to drive progress on ESG Management and Sustainability Impact performance overall.

3.2.2 We will periodically assess the strategic plan established with management to include commercial opportunities and new products/solutions to seize the growth opportunity brought by climate change mitigation and/or adaptation.

3.2.3 While each investment varies on Sustainability Impact and ESG Management performance, we are focused on driving progress and minimising harm throughout the value chain.

3.2.4 We will put the development, approval, and follow-up of such plans on the agenda of the portfolio company’s Board of Directors.

3.2.5 Plans are presented to the Fund’s Supervisory Committee, to anchor KPIs in context of the remuneration policy at fund level. On a yearly basis, a progress report will be presented to the Supervisory Committee.

3.2.6 We help company management to set, meet and exceed ESG objectives. The company assessment methodology is further detailed in Annex B.

3.2.7 At exit, we aim to showcase the improvements in Sustainability Impact and ESG Management that have taken place under our ownership to potential buyers in a quantified and objective fashion.

3.2.8 Overall, we will ensure all staff champion this commitment. As we review our portfolio companies on an annual basis, we will also look at ESG Management and Sustainability Impact improvements in our own fund management operations. Furthermore, as part of our stewardship approach, we will share our lessons learned and best practice examples with broader stakeholders.

*See FSMA_2023_01 van 24/01/2023 – Q&A’s over de inwerkingtreding van de Gedelegeerde Verordening (EU) 2022/1288 van de Commissie van 6 april 2022 tot aanvulling van de SFDR-verordening met technische reguleringsnormen inzake activabeheer (https://www.fsma.be/sites/default/files/media/files/2023-01/fsma_2023_01_nl.pdf).

4. Our regulatory compliance

In line with the Sustainable Finance Disclosure Regulation (“SFDR”) that entered into force in 2021, Junction is required to communicate sustainability-related information to investors. This is because of our pursuit for targeting sustainable investments, labelling our strategy Article 9. Relevant disclosure includes the integration of sustainability risks, the consideration of adverse sustainability impacts, the promotion of environmental or social characteristics and sustainable investment.

We fulfil these requirements through the following standalone documentation:

- Sustainability Risks Policy ( Appendix C)

- Statement on Principal Adverse Impacts ( Appendix D)

- Remuneration policy in relation to the integration of sustainability risks ( Appendix E)

5. Reporting and review

5.1 Being transparent on progress is fundamental to our values as a responsible investor. Through our Sustainable Investment Objective, we demonstrate our portfolio’s contribution to a low-carbon transition.

5.2 For us, establishing and identifying progress in our portfolio companies must be based on objective measurement. We apply a measurement and scoring methodology to all our investments as laid out in Appendix B. It includes measurement of portfolio companies’ eligibility under the EU Taxonomy’s environmental objectives, as well as quantitative indicators on material ESG themes.

5.3 Alongside our scoring methodology for ESG Management and Sustainability Impact highlighted in Appendix B, we will showcase improvements and achievements made by each of our portfolio companies, as well as the performance of our portfolio has a whole.

5.4 The data that we report will be subject to review by the Supervisory Board, which is composed of independent directors, LP- and GP representatives in a balanced way. As we expand our ESG approach and develop our reporting framework, over time, we seek to align our disclosures with frameworks such as the Task Force for Climate-related Financial Disclosures (TCFD) and the Principles for Responsible Investment (PRI).

Alongside our reporting cycle, we will review progress made against this policy and we will update as required to align with our growing ambition.